Guarding Your Properties: Depend On Structure Experience at Your Fingertips

In today's intricate monetary landscape, guaranteeing the protection and development of your possessions is paramount. Depend on structures serve as a keystone for safeguarding your riches and tradition, offering an organized method to asset defense.

Importance of Trust Fund Foundations

Trust foundations play a critical duty in developing integrity and promoting solid relationships in different professional settings. Trust fund structures offer as the keystone for ethical decision-making and transparent interaction within organizations.

Advantages of Professional Assistance

Structure on the foundation of rely on professional partnerships, seeking expert assistance uses very useful benefits for individuals and organizations alike. Expert support offers a riches of knowledge and experience that can assist browse complicated economic, lawful, or strategic obstacles effortlessly. By leveraging the knowledge of specialists in various fields, people and organizations can make informed decisions that align with their objectives and goals.

One considerable advantage of specialist advice is the capacity to access specialized expertise that might not be readily available otherwise. Specialists can use understandings and perspectives that can result in innovative solutions and chances for development. Additionally, functioning with specialists can aid minimize threats and uncertainties by providing a clear roadmap for success.

In addition, professional assistance can save time and resources by simplifying processes and staying clear of pricey mistakes. trust foundations. Specialists can supply individualized advice tailored to certain demands, making certain that every choice is well-informed and strategic. Overall, the benefits of professional support are multifaceted, making it an important asset in guarding and making best use of properties for the lengthy term

Ensuring Financial Protection

Making sure monetary safety entails a diverse method that includes numerous elements of riches management. By spreading investments across different property courses, such as stocks, bonds, genuine estate, and commodities, the risk of substantial financial loss can be reduced.

Furthermore, preserving a reserve is vital to protect against unexpected expenditures or income interruptions. Experts suggest establishing aside 3 to 6 months' worth of living expenditures in a liquid, conveniently available account. This fund acts as a financial security net, supplying peace of mind throughout Read Full Report rough times.

Routinely evaluating and changing financial strategies in response to altering scenarios is likewise paramount. Life events, market fluctuations, and legislative adjustments can impact monetary stability, highlighting the importance of ongoing analysis and adjustment in the pursuit of long-term financial safety and security - trust foundations. By executing these strategies thoughtfully and consistently, people can strengthen their financial footing and job in the direction of a more safe future

Guarding Your Properties Properly

With a strong structure in place for monetary security with diversification and emergency fund upkeep, the following vital action is protecting your possessions effectively. One reliable approach is possession allotment, which entails spreading your financial investments across various possession courses he said to lower threat.

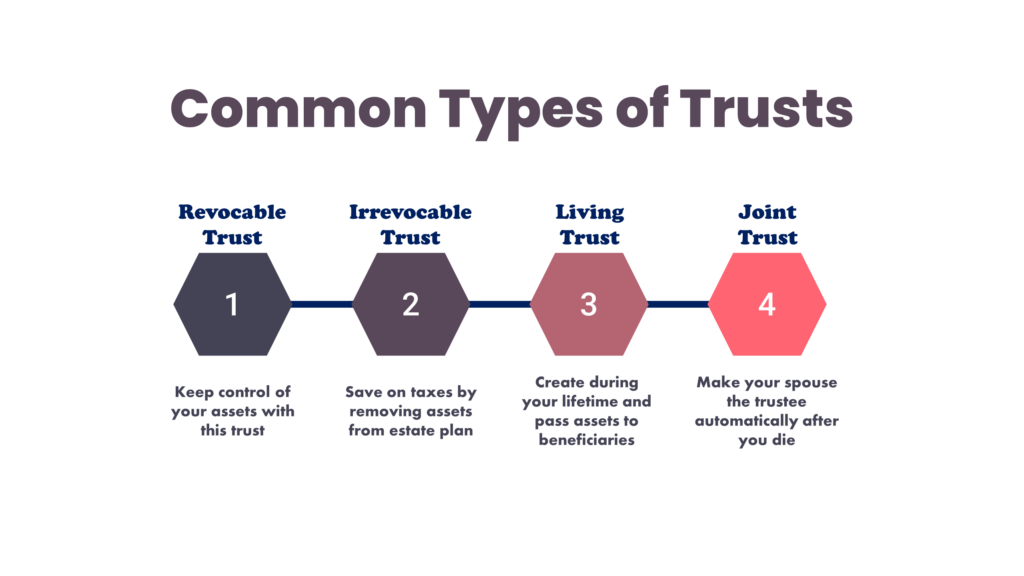

Additionally, establishing a depend on can use a safe means to secure your assets for future generations. Counts on can help you regulate just how your possessions are distributed, decrease estate taxes, and secure your riches from creditors. By executing these strategies and seeking specialist suggestions, you can safeguard your properties effectively and protect your financial future.

Long-Term Property Security

Long-lasting asset defense includes executing actions to protect your properties from various dangers such as economic declines, claims, or unforeseen life events. One essential facet of long-lasting asset security is developing a count on, which can provide considerable advantages in securing your assets from lenders and lawful conflicts.

In addition, diversifying your investment portfolio is one more crucial technique for long-lasting possession protection. By spreading your financial investments throughout various asset classes, markets, and geographical regions, you can minimize the influence of market variations on your general wealth. Additionally, regularly evaluating and upgrading your estate strategy is necessary to make certain that your possessions are safeguarded according to your dreams in the future. By taking an aggressive approach to lasting asset defense, you can guard your wide range and provide financial protection for on your own and future generations.

Final Thought

In conclusion, trust structures play an essential duty in securing assets and use this link ensuring monetary safety. Specialist assistance in developing and taking care of count on frameworks is crucial for long-term property protection. By using the competence of professionals in this area, individuals can successfully guard their properties and prepare for the future with confidence. Count on foundations give a strong framework for shielding wide range and passing it on future generations.