How Opening Offshore Bank Account can Save You Time, Stress, and Money.

Table of ContentsOpening Offshore Bank Account for DummiesThe 2-Minute Rule for Opening Offshore Bank AccountOpening Offshore Bank Account for DummiesThe Opening Offshore Bank Account Statements

3%, some offshore financial institutions can obtain upwards of 3-4%, though this may not adequate reason alone to financial institution within the territory, it does tell you that not all banking systems were developed equivalent. 4. Foreign Banks Have a More Secure Financial System, It is crucial to see to it your assets are saved in a Placing your riches in a safe, and more notably, tried and true banking system is exceptionally crucial.The large industrial financial institutions didn't also come close. Foreign financial institutions are much safer option, for one, they call for higher resources reserves than lots of banks in the United States and also UK. While numerous banks in the UK and United States require approximately just 5% reserves, lots of international banks have a much greater resources reserve ratio such as Belize as well as Cayman Islands which carry average 20% as well as 25% specifically (opening offshore bank account).

While numerous residential accounts restrict your capability in holding various other money denominations, accounts in Hong Kong or Singapore, as an example, permit you to have upwards of a dozen money to selected from all in simply one account. 8 - opening offshore bank account. International Accounts Gives You Greater Property Protection, It pays to have well-protected funds.

The Buzz on Opening Offshore Bank Account

With no access to your possessions, just how can you safeguard yourself in court? Money as well as properties that are maintained offshore are much more challenging to confiscate since foreign governments do not have any type of territory and as a result can not force banks to do anything. Regional courts and also governments that regulate them only have limited influence.

It's not if - it's when. In the United States, there more than 40 million brand-new claims submitted each year, with 80% of the world's legal representatives staying in the USA, that is not as well shocking. If you are struck with a lawsuit you can be practically removed from all try this out your properties before being brought to test.

So be sure to examine your countries arrangements and also if they are a signatory for the Usual Coverage Scheme (CRS). With an offshore LLC, Limited Business or Count on can give a step of privacy that can not be located in any type of personal domestic account. Banks do have a passion in keeping private the names and also details of their clients as in position like Panama where personal privacy is militantly kept, nevertheless, Know Your Consumer (KYC) policies, the CRS and the OECD have actually significantly reshaped financial personal privacy.

Making use of nominee supervisors can also be used to produce an additional layer of security that removes your name from the paperwork. Takeaway, It is never too late to establish a Strategy B.

The smart Trick of Opening Offshore Bank Account That Nobody is Talking About

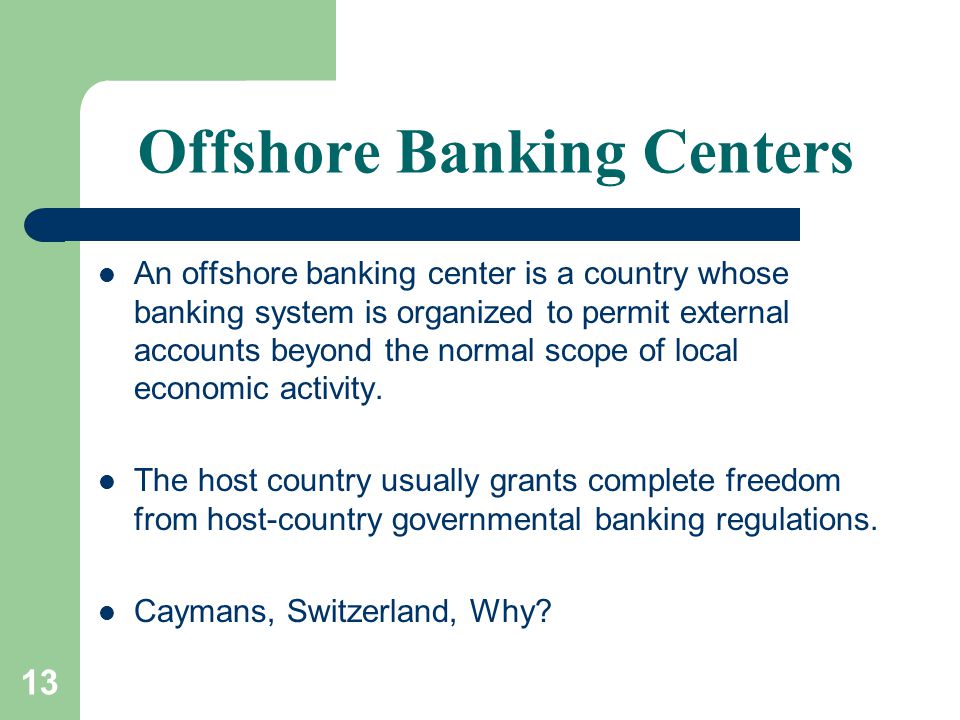

What Is Offshore? The term offshore refers to a place outside of one's house nation., investments, and down payments.

Boosted stress is bring about even more coverage of foreign accounts to worldwide tax authorities. Comprehending Offshore Offshore can refer to a range of foreign-based entities, accounts, or various other economic solutions. In order to certify as offshore, the task happening has to be based in a nation besides the company or capitalist's residence country.

Offshoring isn't typically prohibited. But concealing it is. Special Considerations Offshoring is completely legal because it offers entities with a lot of personal privacy and discretion. Authorities are concerned that OFCs are being used to avoid paying tax obligations. As such, there is increased pressure on these countries to report foreign our website holdings to worldwide tax authorities.

Kinds of Offshoring There are several sorts of offshoring: Service, investing, as well as banking. We have actually entered into some information concerning how these job below. Offshoring Service Offshoring is often referred to as outsourcing when it pertains to company task. This is the act of establishing particular company functions, such as manufacturing or call facilities, in a nation various other than where the business is headquartered.

A Biased View of Opening Offshore Bank Account

Offshore investors might additionally be looked at by regulatory authorities as my response well as tax authorities to make sure tax obligations are paid.

This indicates you can be on the hook if you don't report your holdings. You must do your due persistance if you're going to invest abroadthe exact same means you would certainly if you're working with somebody in the house. Ensure you select a reliable broker or investment specialist to ensure that your money is managed effectively.